Monetary policy is a central bank’s actions and communications that manage the money supply. Central banks use monetary policy to prevent inflation, reduce unemployment, and promote moderate long-term interest rates.

Monetary policy achieves price stability by controlling inflation close to its annual and medium-term targets set by the government. At the same time, central bank also aims to ensure financial stability, particularly the smooth functioning of the financial market and the payment system.

Definitions and Examples of Monetary Policy:

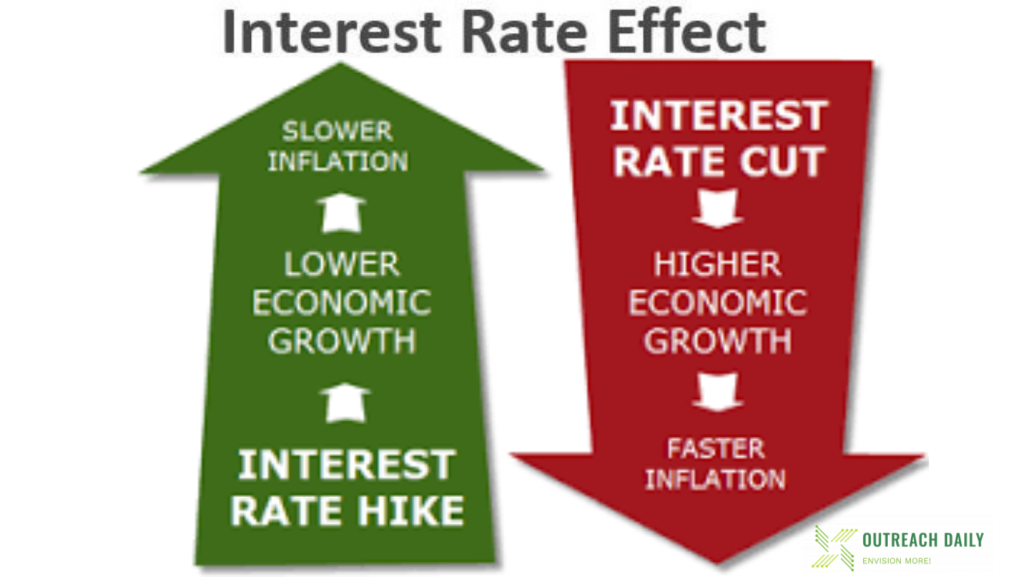

Monetary policy increases liquidity to create economic growth. It reduces liquidity to prevent inflation. Central Banks use interest rates, bank reserve requirements, and the number of government bonds that banks must hold. All these tools affect how much banks can lend. The volume of loans affects the money supply.

The money supply includes forms of cash, credit, cheques, and money market mutual funds. The most important of these forms of money is credit. Credit includes loans, bonds, and mortgages.

In a recession, central banks might combat high unemployment by giving banks more money. Banks in turn lower interest rates, which allows businesses to hire more employees. This is an example of expansionary monetary policy.

Monetary Policy Objectives:

Central banks have three monetary policy objectives. The most important is to manage inflation. The secondary objective is to reduce unemployment, but only after controlling inflation. The third objective is to promote moderate long-term interest rates.

For example, The U.S. Federal Reserve, like many other central banks, has specific targets for these objectives. It wants the core inflation rate to be around 2%. Also it prefers a natural rate of unemployment of between 3.0% and 4.5%.

Types of Monetary Policy:

Central banks use contractionary monetary policy to reduce inflation. They reduce the money supply by limiting the volume of money banks can lend. The banks charge a higher interest rate, making loans costlier. Less businesses and individuals borrow, slowing growth.

Central banks use expansionary monetary policy to lower unemployment and avoid recession & slump. They increase liquidity by giving banks more money to lend. Banks lower interest rates, making loans cheaper. Businesses borrow more to buy equipment, hire employees, and expand their operations. Individuals borrow more to buy more homes, cars, and appliances. That increases demand and spurs economic growth.

Monetary Policy vs. Fiscal Policy:

Ideally, monetary policy should work hand-in-glove with the national government’s fiscal policy. It rarely works this way. Government leaders get re-elected for reducing taxes or increasing spending. As a result, they adopt an expansionary fiscal policy. To avoid inflation in this situation, the Fed is forced to use a restrictive monetary policy.

For example, after the Great Recession, US Congress became concerned about the debt. It exceeded the debt-to-GDP ratio of 100%. As a result, fiscal policy became contractionary just when it needed to be expansionary. To compensate, the Federal Government injected massive amounts of money into the economy with quantitative easing.

Monetary Policy Tools:

All central banks have three tools of monetary policy in common.

Open Market Operations:

Central banks all use open market operations (OMO). With OMO, the central bank can create new money by buying government securities, such as Treasury bonds, and issuing new money. The central bank can likewise contract the money supply by selling those securities from its balance sheet and removing the money received from circulation.

The Reserve Requirement:

The reserve requirement is when the central banks tell their members how much money they must keep on reserve each night. Not everyone needs all their money each day, so it is safe for the banks to lend most of it out. That way, they have enough cash on hand to meet most demands for redemption. Previously, this reserve requirement has been 10%. However, effective March 26, 2020, the Fed has reduced the reserve requirement to zero.

When a central bank wants to restrict liquidity, it raises the reserve requirement. That gives banks less money to lend. When it wants to expand liquidity, it lowers the requirement. That gives members banks more money to lend. Central banks rarely change the reserve requirement because it requires a lot of paperwork for the members.

The Discount Rate:

The discount rate is the interest rate charged to commercial banks and other financial institutions for short-term loans they take from the Central Bank. The discount rate refers to the interest rate used in discounted cash flow (DCF) analysis to determine the present value of future cash flows.

There are two primary discount rate formulas – the weighted average cost of capital (WACC) and adjusted present value (APV). The WACC discount formula is: WACC = E/V x Ce + D/V x Cd x (1-T), and the APV discount formula is: APV = NPV + PV of the impact of financing.

The monetary policy is very important where the central bank plays the role to change and update at its timeline.

The writer is having vast experience in Banking and Finance sector for over one and half decade, where during his period of work he has experienced different economic and development initiatives taken for the wellbeing of the public masses through the banking channel.

He has worked for the Microfinance banks which are offering community based services among the under developed segment of the society.

The major work done in Financial Inclusion where several hundreds of people were brought to Banking channel to improve their businesses.

The under served segment of society like woman were given the chances to change their lives through credit facilities to grow their home based businesses which is also an imitative of Women Empowerment.

The Writer has also worked against different social issues and highlighting them for positive change in the society through public awareness and their active involvement to reach to the solution.

This journey of empowering people is on going and is never lasting till the time last person remains underserved.