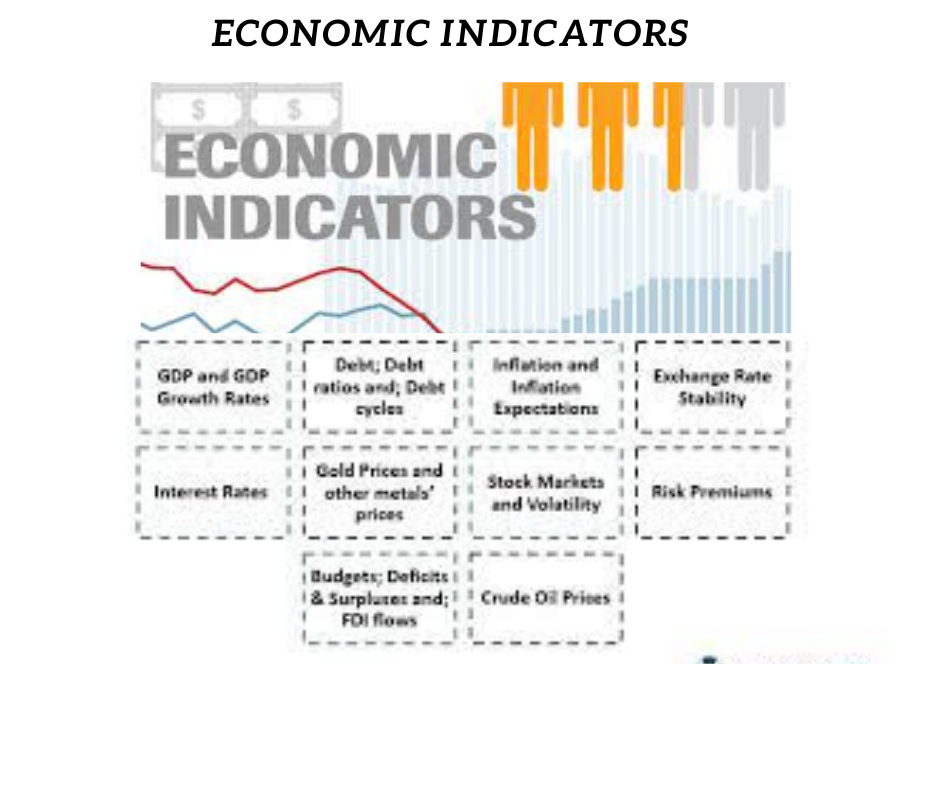

The Economic Indicators are the important signs of economy of any country which indicate the economic growth and country’s outlook in the eyes of foreign investors and businessmen. In this article we will see these indicators in continuation of previous article.

Rest of the Economic Indicators:

Consumer Price Index (CPI):

CPI is a lagging indicator as it is one of the best indicators of inflation. The consumer price index is an important indicator to analyze the inflation and then to make changes in monetary policy.

CPI is measure of changes in prices paid for goods and services by urban consumers for a specified month. It’s essentially a measure of the cost of living changes. It offers a gauge of inflation as it relates to purchasing those goods and services.

Producer Price Index (PPI):

PPI is a coincident indicator that tracks price changes in almost all goods-producing sectors, including mining, manufacturing, agriculture, forestry and fishing. PPI also tracks price changes for an increasing portion of the non-goods-producing sectors of the economy. The report measures prices for finished goods, intermediate goods and crude goods.

PPI is important because it’s the first inflation measure available in the month. It captures price movements on a wholesale level before price changes show up on the retail level.

Balance of Trade:

Balance of trade is a lagging indicator. It’s the net difference between a country’s value of imports and exports and shows whether there is a trade surplus or a trade deficit. A trade surplus is generally desirable and shows that there is more inflow of money in the country than outflow. A trade deficit shows that there is more outflow of money in the country than inflow. Trade deficit can lead to substantial domestic debt. In the long term, a trade deficit can result in a devaluation of the local currency, since it leads to significant debt. The increase in debt will reduce the credibility of the local currency. It could also lead to a major financial burden for future generations since they will be forced to pay off that debt.

However, if a trade surplus is too high, a country may not be taking advantage of the opportunity to purchase products from other countries. In a global economy, nations specialize in manufacturing specific products while buying the goods other nations produce more efficiently at a cheaper rate.

Housing Starts:

Housing starts are a leading indicator. Housing starts are an estimate of the number of housing units on which some construction was performed that month. Data is provided for multiple-unit buildings as well as single-family homes. The data also indicates how many homes were issued building permits and how many housing construction projects were initiated and completed.

Housing starts are highly sensitive to changes in mortgage rates, which are affected by shifts in interest rates. Although housing starts are a highly volatile indicator, they represent in the annual GDP. As a result, they can signal the effects of current financial conditions as well as changes in the economy. Economists and analysts watch for longer-term trends in housing starts.

Currency Strength:

Currency strength is a lagging indicator. When a country has a strong currency, its purchasing and selling power with other nations is increased. A country with a strong currency can import products at a cheaper rate and sell its products overseas at higher foreign prices. However, when a country has a weaker currency, it can draw in more tourists and encourage other countries to buy its goods since they are cheaper.

Interest Rates:

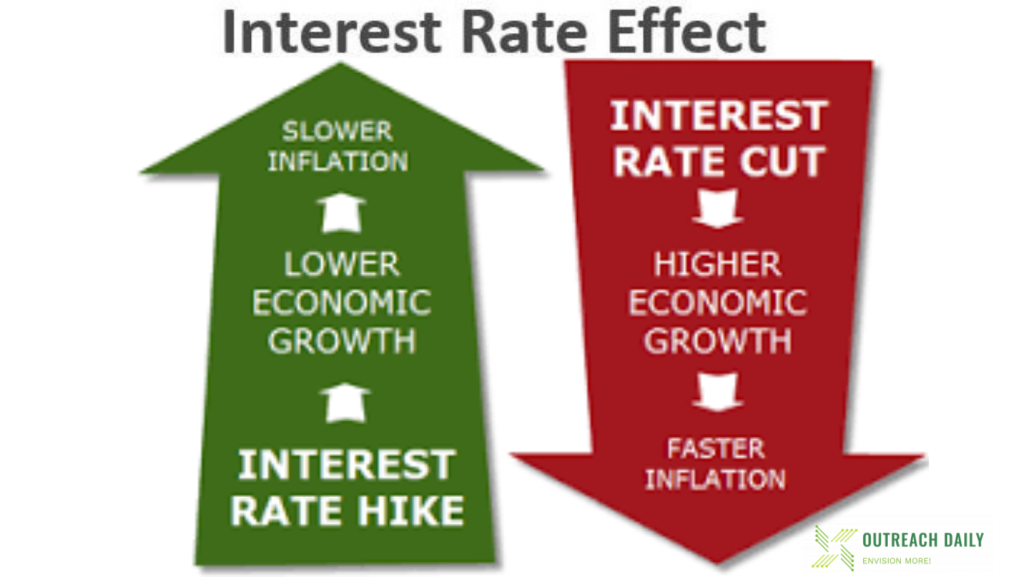

Interest rates are a lagging indicator of economic growth. They are based on the Central Bank’s monetary policy, which is determined by the Central Bank of the country. When the central bank increases the interbank offer rate then interest rate increases. The policy rate increases or decreases as a result of economic and market events.

When interest rates increase, borrowers are more reluctant to take out loans. This discourages consumers from taking on debt and businesses from expanding, and as a result, GDP growth may become stagnant.

If interest rates are too low, that can lead to an increased demand for money and raise the likelihood of inflation. Raising inflation can distort the economy and the value of its currency. Current interest rates are indicative of the economy’s current condition, and can also suggest where the economy might be headed.

Manufacturing Activity:

Manufacturing is a leading economic indicator. Durable goods orders are an indicator of manufacturing activity. The term “durable goods” refers to consumer products that usually aren’t replaced for at least a few years, such as refrigerators and cars.

Durable goods orders are a measure of new orders manufacturers receive for those types of goods. An increase in durable goods orders is generally taken as a sign of economic health, while a decline might indicate trouble in the economy. Increases and decreases in durable goods orders may also be associated with increases and decreases in stock indices respectively.

Income and Wages:

Income and wages are lagging indicators. When the economy is operating properly, earnings should increase to keep up with the average cost of living. However, when incomes decline relative to the average cost of living, it is a sign that employers are either laying off workers, cutting pay rates or reducing employee hours. Declining incomes can also indicate an environment where investments are not performing as well.

Incomes are broken down by different demographics, like age, gender, level of education and ethnicity. These demographics can give insight into how wages change for certain groups. A trend that may affect what seems to be only one smaller group may actually suggest an income problem for the entire country, rather than just the group it initially affects.

Consumer Spending:

This indicator acts like a leading indicator, but it’s actually a coincident indicator. This is because decreases can raise the fear of recession and increases often precede higher CPI numbers.

Its rise and fall can have a direct impact on the stock market, or at least the retail sector. When sales are higher, consumers are spending more and companies tend to perform better. When sales are lower, the reverse is true.

The Bottom Line:

There’s no golden hen in investing, but considering these economic indicators can help you make informed investment decisions. The Bottom line analysis outlines the nation’s economic conditions and it can be a useful resource for investors, economists and analysts.

Economic indicators are important to take into account before making any investment decisions. With a little research, you’ll be able to maximize your portfolio.

The writer is having vast experience in Banking and Finance sector for over one and half decade, where during his period of work he has experienced different economic and development initiatives taken for the wellbeing of the public masses through the banking channel.

He has worked for the Microfinance banks which are offering community based services among the under developed segment of the society.

The major work done in Financial Inclusion where several hundreds of people were brought to Banking channel to improve their businesses.

The under served segment of society like woman were given the chances to change their lives through credit facilities to grow their home based businesses which is also an imitative of Women Empowerment.

The Writer has also worked against different social issues and highlighting them for positive change in the society through public awareness and their active involvement to reach to the solution.

This journey of empowering people is on going and is never lasting till the time last person remains underserved.