Introduction:

Innovation means something new or something which had not been done before. The same is the case with banking section as well. There are many segments in banks which are transforming and have gone through innovation in recent past. They are no longer restricted to traditional methods. Therefore, to increase the business avenues and to capture the new market, the banks are resorting to innovation. This term innovative banking is being in use a lot nowadays. Innovation enables banks to meet the changing customer expectations that’s why banks streamline their internal processes to maintain their market share.

Innovative Banking Segments:

- Mobile Banking

- Internet Banking

- Retail and Wholesale Banking

- Universal Banking

1. Mobile Banking:

Mobile banking is the act of making financial transactions on a mobile device (cell phone, tablet, etc.). A prominent mobile banking advantage is that it is similar to carrying a bank in your pocket. Mobile Banking reduces the need to visit banks for minor banking activities. You can access mobile banking services from any place, at any time.

This activity can be as simple as a bank sending fraud or usage activity to a client’s cell phone or as complex as a client paying bills or sending money abroad.

Types of Mobile Banking:

- Mobile banking is classified into 3 types – App-based banking, SMS banking, & USSD Banking.

- Mobile banking applications encompass the broadest range of banking services.

- You can transfer funds, make investments and book Fixed Deposits through app-based banking.

2. Internet Banking:

Internet banking, also known as online banking, e-banking or virtual banking, is an electronic payment system that enables customers of a bank or other financial institution to conduct a range of financial transactions through the financial institution’s website.

It’s quick, usually free and allows you to do tasks, such as paying bills and transferring money, without having to visit or call your bank.

It eventually offers you security from online frauds and account hacking. Even if it is the last day of your bill payment and you are minutes away from being charged a penalty, you can rely on internet banking. Online transactions can be performed anytime of the day from the convenience of your home.

Types of Internet Banking:

- Basic Level or Informational Internet Banking. The basic level refers to a bank’s website, which provides information on various products and services it offers.

- Intermediary or Communicative Internet Banking.

- Advanced or Transactional Internet Banking.

Features of internet banking:

- Safe and secure method of banking;

- Hassle free process;

- Escaping of queues for all utility bill payment;

- Easy transfers from one account to another;

- Unique user id and password;

- Application for fresh cheque book;

- Keep a check on your balance and all investments.

Internet banking also provides various services:

- RTGS funds transfer;

- Balance Check;

- Utility bill payment;

- Open or close fixed deposit account;

- Buy Insurance;

- Set-up auto payment;

- Book all kinds of tickets online;

- Issue of Cheque book;

- Buying/selling Shares, IPOs;

- Buying or Selling using E-commerce websites;

- Daily Account Statements.

3. Retail and Wholesales Banking:

Like other businesses, the banking sector too has advanced into retail and wholesale banking and it is also one of the parts of innovative banking.

Retail banking refers to the banking in which the transactions which are done daily by the banks are executed with consumers.

Thus, this is done instead of transactions with other banks or other corporates.

The services under this are:

- Savings accounts

- Checking accounts

- Personal loans

- Debit card

- Credit card

Wholesale banking is completely the opposite of retail banking. It refers to the business being conducted with the business and industrial entities.

Thus, in wholesale banking, trading houses, domestic companies, and multinational companies are included. So, there are many services which are included in the wholesale banking and these services are:

- Value-added services

- Fund based services

- Non-fund related services

- Internet banking

- Multinational and offshore banking

Multinational banking is the banks that are present in more than one country. The main services are available in more than one country in these services. Thus, these banks are also called international banks.

While under offshore banking, the banking activities are performed in the currencies that are different than the currency of the country in which the bank account is opened. The banking services in these banks remain the same though.

4. Universal Banking:

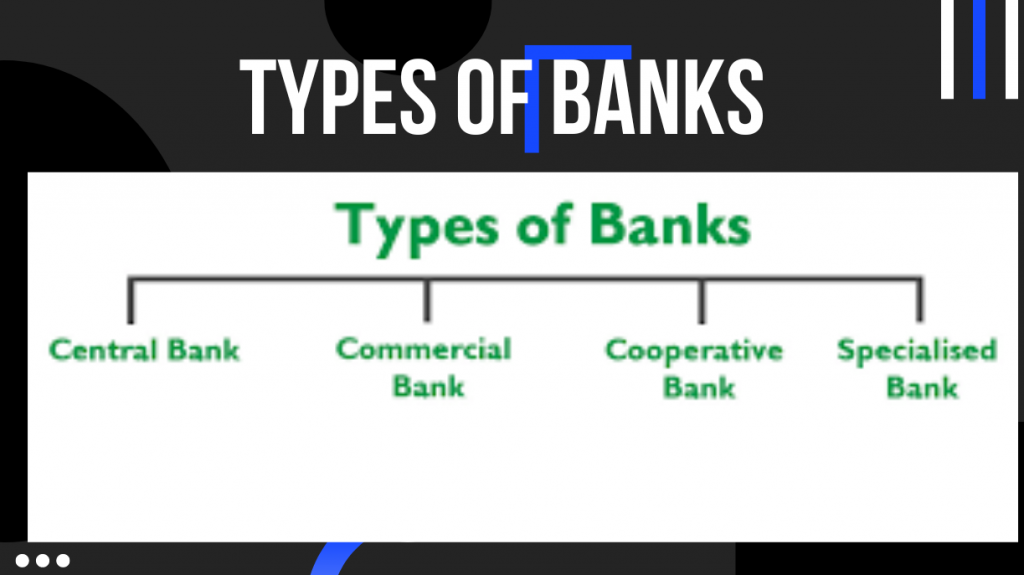

Universal Banking, means the financial entities – the commercial banks, Financial Institutions, NBFCs, – undertake multiple financial activities under one roof, thereby creating a financial supermarket. The entities focus on leveraging their large branch network and offer wide range of services under single brand name.

They offer the widest variety of banking services among financial institutions. In addition to the function of an ordinary commercial bank, universal banks are also authorized to engage in underwriting and other functions of investment houses, and to invest in equities of non-allied undertakings.

The writer is having vast experience in Banking and Finance sector for over one and half decade, where during his period of work he has experienced different economic and development initiatives taken for the wellbeing of the public masses through the banking channel.

He has worked for the Microfinance banks which are offering community based services among the under developed segment of the society.

The major work done in Financial Inclusion where several hundreds of people were brought to Banking channel to improve their businesses.

The under served segment of society like woman were given the chances to change their lives through credit facilities to grow their home based businesses which is also an imitative of Women Empowerment.

The Writer has also worked against different social issues and highlighting them for positive change in the society through public awareness and their active involvement to reach to the solution.

This journey of empowering people is on going and is never lasting till the time last person remains underserved.