The financial industry isn’t the easiest one to understand. There are many different factors and sectors to get to grips with, each with their own set of rules and criteria involved. This can make trying to get your head around a financial concept seem like a daunting task, but deepening your understanding of these elements could help you make the right decisions when it comes to your own finances, earnings and spending.

These days most often different terms like Banking and Non-Banking Finance institutions (NBFIs) terms are used to distinguish between the working of their model.

Today we will get to know the difference between Banking and Non-Banking Institutions,

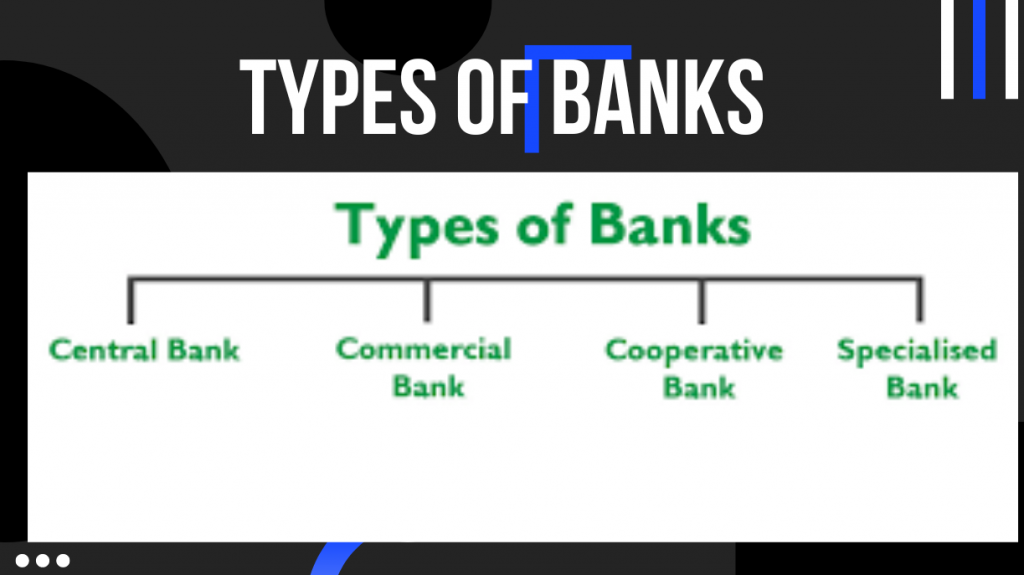

A bank is a legally recognized financial institution with the mission of offering consumers financial services, Banks take deposits and lend money. While Non-Banking institutions (NBFI) are businesses that offer individuals banking-like services without having a bank license as they do not take deposits to make loans.

| What is the difference between NBFI and Bank? | |

| Bank | Non-Banking Finance Institutions |

| A bank is a legally recognized financial institution with the mission of offering consumers financial services. | Non-Banking Finance Institutions are businesses that offer individuals banking-like services without having a bank license. |

| Banks take deposits and lend money. | NBFC does not take deposits to make loans. |

| In banks, foreign capital is restricted to a set amount. | Foreign investment in NBFI is permitted up to 100%. |

| The primary function of banks is payments and settlements. | The payment method is not a component of the business of NBFI. |

| A bank may issue a self-demand draught. | NBFC is not permitted to publish self-demand draughts. |

| Banks have the ability to self-draw a check. | NBFI is unable to write its own checks. |

Examples non-banking institutions?

Examples of nonbank financial institutions include insurance firms, venture capitalists, currency exchanges, some microloan organizations, and pawn.

NBFIs are generally praised within the financial sector for offering a greater range of choice to people with financial opportunities and concerns. For example, know US economist Alan Greenspan spoke about how the role of NBFIs has worked to strengthen the economy, as they provide “multiple alternatives to transform an economy’s savings into capital investment which act as backup facilities should the primary form of intermediation fail.”

The role of Non-Bank Financial Institutions in the wider industry:

For most people, the bank is the first port of call when seeking out financial aid or advice. However, many people also find that the services offered by the bank don’t adequately meet their requirements, leaving them at a loss for what to do next.

While banks tend to offer a set of financial services as part of a clear packaged deal, NBFIs unbundle these offers and tailor their services to meet the needs of the specific client. Therefore, many people who can’t find help at the bank can find it with an NBFI.

The role of NBFIs is generally to allocate surplus resources to individuals and companies with financial deficits, allowing them to supplement banks. By unbundling financial services, targeting them and specializing in the needs of the individual, NBFIs work to enhance competition in the financial sector.

The kinds of services offered by non-bank financial institutions generally fall in one of three categories, which we have outlined in further detail below.

Risk Pooling Institutions

These are organizations such as insurance companies which underwrite economic risks associated with a series of factors, including illness, death, damage and risk of loss. In return for collecting an insurance premium, these organizations provide a promise of economic protection in case of loss.

There are two key kinds of insurance companies: general insurance and life insurance. The former tends to be a short term agreement, while life insurance can be agreed on a much longer term basis.

Institutional Investors

This category refers to organizations such as pension funds and mutual funds. These are the institutions which trade securities in volumes that qualify for lower commissions.

These are also known as contractual savings institutions. Mutual funds can be either open ended or closed ended.

Other Non-Bank Financial Institutions

These are other forms of NBFI which provide financial services such as the leasing of assets, company management, financial advice, security brokering and market makers, who provided liquidity.

It may also refer to specialized sectorial financiers who provide a limited range of services to a targeted sector, such as real estate financers or payday lending companies.

To Conclude:

The entire discussion can be summarized as follows:

(a) The distinction between Banks and NBFIs has been too sharply drawn. The differences are of degree rather than of kind,

(b) The differences which do exist have little intrinsically to do with the monetary nature of bank liabilities,

(c) The differences are more importantly related to the special reserve requirements. If NBFIs are subject to the same kind of regulations, they would behave in much the same way.

(d) Banks do not possess a ‘widow’s cruse’ which means that any expansion of assets will generate a corresponding expansion of deposit liabilities. Despite these differences, banks are unique among financial intermediaries.

The writer is having vast experience in Banking and Finance sector for over one and half decade, where during his period of work he has experienced different economic and development initiatives taken for the wellbeing of the public masses through the banking channel.

He has worked for the Microfinance banks which are offering community based services among the under developed segment of the society.

The major work done in Financial Inclusion where several hundreds of people were brought to Banking channel to improve their businesses.

The under served segment of society like woman were given the chances to change their lives through credit facilities to grow their home based businesses which is also an imitative of Women Empowerment.

The Writer has also worked against different social issues and highlighting them for positive change in the society through public awareness and their active involvement to reach to the solution.

This journey of empowering people is on going and is never lasting till the time last person remains underserved.